Exit prohibition due to a tax debt of 1 million VND, in recent days the media has continuously reported on the fact that many business leaders have been banned from leaving the country due to tax debts, even with very small amounts of less than 1 million VND. Many opinions suggest that the postponement of the exit of business leaders just because of a tax debt of 1 million VND is a bit excessive. Is that true or not? Let's find out in this article.

Recent incidents

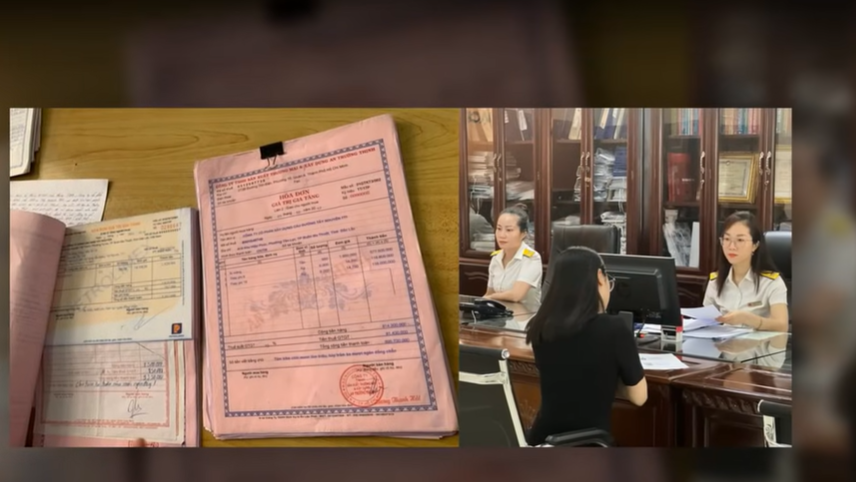

In the past month, the customs departments under the Ho Chi Minh City Customs Department have issued decisions to temporarily suspend the exit of 12 individuals who are legal representatives of businesses due to tax debts. Notably, the temporary exit suspension is applied to cases of tax debts with significant discrepancies, regardless of the severity. Not only in Ho Chi Minh City, the tax department of Bien Hoa Vinh Cuu area, under the Dong Nai Provincial Tax Department, has also sent a notice requesting the Immigration Department, Ministry of Public Security to temporarily suspend the exit of 64 individuals who are legal representatives of tax-debted businesses. Previously, in October 2023, the tax department of District 7, Nha Be District, under the Ho Chi Minh City Tax Department, also requested the competent authority to ban the exit of 11 individuals who are legal representatives of 11 tax-debted businesses. In addition, there are some cases where many people only find out about their exit suspension due to tax debts when they arrive at the airport. According to Mr. Nguyen Tien Dung, Deputy Director of the Ho Chi Minh City Tax Department, the law allows the tax sector to send a notice requesting the Immigration Department to temporarily suspend the exit of tax violators. Mr. Dung also confirmed that after these individuals fully pay their taxes, the tax agency will notify the Immigration Department to lift the exit suspension.

Are there other measures?

Although the temporary exit suspension is applied to businesses with tax debts, the reality shows a significant difference in the amount of tax debt among cases, with some businesses having tax debts amounting to tens of billions of VND. Meanwhile, there are also businesses with debts of only a few hundred thousand VND, typically the case of the director who is the legal representative of Gia Thang Chemical Trading Limited Company. The person was proposed to have their exit suspended due to this business's tax debt of more than 997,000 VND, excluding late payment penalties. According to the perspective of businesses, the ultimate goal of applying sanctions against tax-debted businesses is to recover the debt amount for the state budget. Therefore, the measure of freezing the business's account should be prioritized. A business director in District 7 shared that in 2023 he received a notice from the District 7 tax department regarding his business's value-added tax debt of about 10 million VND. The tax agency required the business to pay the tax within 5 days from the date of the notice, or else they would apply sanctions including requesting an exit suspension. This director stated that the company's accountant had completed the tax report but forgot to pay the tax, and as soon as they received the notice, they immediately paid the tax and the penalty. He also expressed the view that they did not intentionally evade taxes but due to the oversight of the specialized department and rectified it immediately after receiving the tax agency's notice. However, through this incident, I realize that the tax agency could choose other methods to recover tax debts and support businesses more effectively.

Initial tax enforcement measures include freezing bank accounts and notifying that invoices are no longer valid. If the business still does not pay taxes, after applying these measures, the tax agency must apply many other measures. Among them is the request to ban the exit of the legal representative; the tax agency is the unit responsible before the law for the business owner's exit ban. Regarding businesses that only owe a few million VND in taxes also being banned from exiting, the inspector stated that one of the important tasks of the tax sector is to focus on recovering tax debts, ensuring revenue for the state budget. Therefore, the tax agency must apply enforcement measures so that businesses are responsible for fulfilling their obligations to the budget. If not implemented, superiors will question why the tax agency does not enforce legal regulations. However, the inspector also believes that the flexible exit ban for tax-debted businesses needs state policy and legal adjustments regarding taxes.

Tax debt, even one VND, is a violation

Lawyer Nguyen Quoc Toan, director of IAM Law Firm in Ho Chi Minh City, affirmed that: Tax debt, even just one VND, is a violation of the law. Individuals and businesses related to overdue tax debts must be treated equally. According to legal regulations, taxes do not distinguish between rich and poor, there is no such thing as owing little or owing much, but only overdue debts, which means violations. Lawyer Toan cited the story of an American man, who, just because of a property tax of 500 dollars that he had paid but forgot about the accumulated interest. During the payment review period, the amount was 8.41 dollars, resulting in his house worth 60,000 dollars being seized three years later. Lawyer Toan emphasized that owing more than 8 dollars can still lead to asset seizure; the principle of American law is that if the property owner does not pay enough taxes in the previous year, they will be considered tax debtors. Applying to the case of a business with a tax debt of nearly 1 million VND, lawyer Toan believes that this amount may seem small at first, but if considering the overdue interest over the past 11 years, the debt amount certainly does not stop at 1 million VND.

In agreement, Associate Professor Dr. Dinh Trong Thinh, Academy of Finance, a financial economic expert, stated: Taxes are the highest legal regulations that contribute to the state budget, which every individual and business with revenue and profit must pay. In principle, businesses and their legal representatives must calculate, declare, and comply with tax payment obligations. Associate Professor Dr. Thinh explained: Simply put, the decisions to temporarily suspend exit or customs enforcement related to tax debts aim to ensure the rule of law of businesses and entrepreneurs who have established businesses. As a legal representative of a business, one must prioritize the rule of law. The tax debt notices and tax enforcement are sent many times to the business. During that time, the legal representative of the unit cannot be unaware or think that the small amount is not worth paying attention to. I believe there should be no distinction or leniency for such overdue tax debt cases.

Who is responsible for the delay in tax refunds?

In the context of the tax sector tightening and the collection and handling of tax debts, many businesses believe that the tax agency should also be held accountable for delays in tax refunds. Recently, the Vietnam Rubber Investment Limited Company reported that the business has been delayed in tax refunds for about 2 years, with an amount up to nearly 70 billion VND. In fact, the delayed tax refund amount is currently larger than the company's charter capital, forcing the business to temporarily cease operations due to lack of working capital. The company's representative stated that although facing many difficulties, the business cannot dissolve because if it dissolves, the procedures to receive tax refunds later will become increasingly difficult. Being temporarily held for tens of billions of VND in value-added tax has caused the business to lose financial resources, unable to fulfill export orders, and continuously lose customers. Earlier, in 2023, many wood industry businesses also reflected that getting value-added tax refunds was as difficult as reaching the sky.

A typical case is that of Focus Vietnam Joint Stock Company, which has been delayed in tax refunds of 355 billion VND and has sent 29 applications for tax refund periods from June 2020 to February 2023. Some businesses reported that they were affected by businesses that closed and fled from their registered business addresses while the tax refund application needed to verify invoices and documents from these businesses. According to lawyer Nguyen Quoc Toan, the value-added tax refund is essentially the tax that the business has paid when purchasing goods domestically for processing export goods. This means that the business has advanced money to the state budget, so after the business meets the requirements, the tax agency must be responsible for refunding. However, not all businesses can fully meet the requirements for documents and invoices for tax refunds. Therefore, most applications are delayed due to not meeting the conditions or being stuck in the process of verifying invoices and documents.

This situation is particularly common in the context of thousands of businesses closing or going bankrupt each month. Lawyer Toan stated that invoice verification is an internal matter of the tax sector; however, the tax sector must ensure that the legal regulations are to resolve tax refund applications for businesses within 40 days. The responsibility of the tax sector is not only to collect taxes correctly, fully, and timely but also to be responsible for preventing tax evasion and tax fraud. Especially to prevent the appropriation of the state budget through value-added tax refunds. If the investigation and verification are not thorough, leading to the appropriation of the state budget, the tax department will be held accountable. In fact, there are currently no regulations on how the tax agency will be handled for delays in tax refunds.